What Is Technical Analysis? A Beginner’s Guide

Updated: June 19, 2024

Published: June 10, 2021

If you’re interested in stocks, trading, and finances, then you might have heard the term ‘technical analysis’ thrown around before. But just what exactly does it mean and how is it relevant?

Here, we’ll go over the definition of technical analysis, break down its theory, look at the pros and cons of different approaches, and compare it to other forms of analysis. Keep reading to learn more about this interesting topic.

How to Learn Technical Analysis

If you already know what is technical analysis, you have made your first step in trading and investments. The next step is starting your learning journey to become an expert in trading.

But many people find it difficult to identify a path that fits their style of learning technical analysis. Consider the following steps for effective learning:

Familiarize With the Basics

Before you become a technical analysis guru, you need experience. You need to understand the fundamentals of this discipline and its central elements. The following resources can help you do that:

- Educational website

- Books

- Seminars

- Online or in-person courses

There are many books and articles available for beginners and those with a newfound interest in stock technical analysis. While some of these sources are fee-based, many are available for free from libraries and online sources.

Practice in a Controlled Environment

As you continue to build your knowledge of technical analysis, consider practicing in a controlled setting. In a controlled trading environment, you can gain experience without risking your finances. Some of the best-controlled environments include:

- Paper trading: This involves using a stock market simulator with real-time data. These environments allow beginners to compare their investments to the real stock market.

- Backtesting: This involves using historical data to predict real stock market results. Online automated backtesting systems can help you gain practical skills.

Apply Your knowledge in Real Market

Once you understand what is technical analysis, you can apply your knowledge to make real trades and investments. Start with low-risk stakes until you gain experience in making high-risk trading decisions.

If you work with a trading organization, you can learn from professionals. You can also build a network with experienced traders and investors.

Difference Between Fundamental and Technical Analysis

Fundamental analysis uses a longer time period for stock analysis. This is a good strategy for investors who focus on stocks that are likely to appreciate in the near future. Technical analysis, however, is of interest to investors interested in short-term trading; it aids traders in making investment decisions.

The decision to use fundamental analysis is based on information evaluation and available statistics. You can use cash flow statements and company incomes to predict future performance. Technical analysis investors, on the other hand, make their decisions by observing market trends and stock prices. For example, a stock chart can show how public shares of certain companies are performing.

Types of Technical Analysis

The Bottom-Up and Top-Down approaches have the same goal; they help investors identify great stocks.

Top-Down Approach

Investors who follow the top-down approach focus their trading decisions on industry performance. They believe that the value of a stock increases when an industry is thriving.

Top-down trade analysis may include:

- Inflation and prices of commodities

- Economic growth or GDP in the United States and other countries

- Bond prices and yields

- Monetary policy by the Federal Reserve Bank

For example, a top-down trader might consider rising interest rates and bond yields to invest in bank stocks.

Bottom-Up Approach

In the bottom-up approach, investors observe stocks regardless of the current market trend. They also do not care about macroeconomic indicators and market conditions. Instead, the bottom-up approach focuses on the performance of independent companies rather than the industry.

The bottom-up focus on:

- Analyzing financial statements of specific companies. They include cash flow statements, income statements, and balance sheets.

- Performance of an organization’s management and leadership team

- A company’s market share, products, and market dominance.

- Sales and revenue trends

- Earnings growth, including anticipated future earnings.

Investors who take the bottom-up approach focus on companies that are likely to outperform others. They believe that some companies within an industry may do well.

Best Analysis for Trading

There is no blueprint for the best type of technical analysis. The right one depends on your trading goals, your preferred method, and your risk tolerance.

You can choose the bottom-up or top-down approach depending on your objectives. Else, you can opt for a hybrid approach. This means that you combine the two approaches to develop your portfolio. For example, you can start your portfolio with the top-down approach. Later, you can switch to the bottom-up approach when you decide to realign it depending on what you consider right for you.

If you’re still not sure what is technical analysis, taking a course from University of The People can help build your trading and investment career.

Required Skills for Technical Analysis

Wondering what technical analysis techniques you need to start your trading career? Do not worry! There are several paths to becoming an expert technical analyst. First, you need to understand what is technical analysis. Second, you must have research, analytical, record-keeping, and focus skills.

Research Skills

You must have the curiosity to identify relevant data that impacts the securities you want to trade. You can record economic releases with significant impact on the financial markets.

Being on top of such data allows you to act on the information.

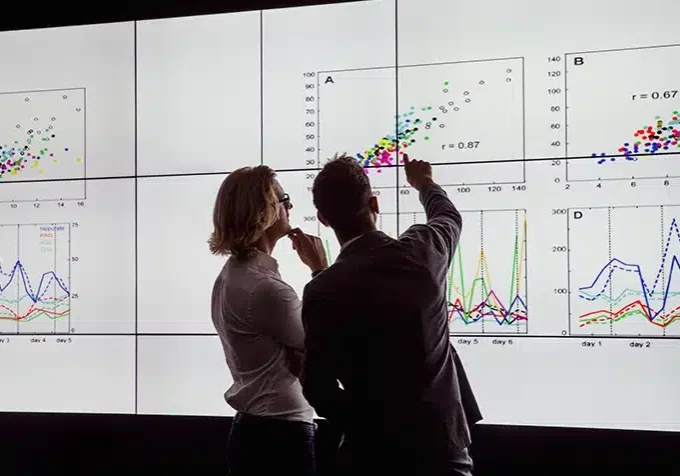

Analytical Skills

The ability to analyze data quickly is one important skill you will need. There is a lot of information presented in charts and trading patterns. So, you need to have analytical skills to identify and understand trends in charts.

Record Keeping Skills

Keeping records when trading and investing requires knowledge. When you record the results of your trades, you’ll have an easier time finding successful trading.

Focus Skill

Focus is an essential skill that grows with practice. There is a lot of information about the technical analysis of stocks. Therefore, you must focus only on significant actionable data that can affect your trades. However, to acquire these skills, you need to enroll in a course in technical analysis.

To Wrap Up

There’s a lot more that can be discussed about technical analysis, but hopefully, this gave you a good introduction to the field.

If you love working with numbers, statistics, and probabilities, then working as a technical analyst might be a really exciting career for you.

The University of the People can help you achieve your goals. Our affordable programs are online and accessible from all parts of the world. You can graduate debt-free with the knowledge you need to become a leader in technical analysis. Contact us today for more information.