UoPeople Blog

Browse our blog for the latest in education news, industry insights, and tips to enhance your online learning experience.

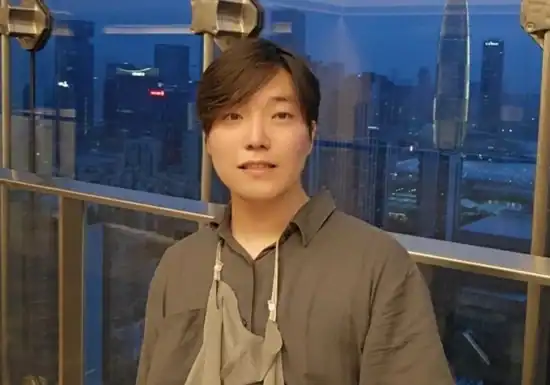

Featured Post | Alumni

Though I was born and raised in South Korea, my life has been enriched by a wide range of global experiences. I completed my undergraduate studies in Chinese Language and Literature at Zhejiang University, one of China’s top universities.